The lead-up to the central bank's announcement was like anticipating reality TV. Would Jay Powell fall short of expectations? Would he be right on the money? Would everyone be mad?

For what it's worth, stocks certainly initially acted as if Powell made the right move.

Phil Rosen here, coming to you from New York — let's break it down.

1. The Fed made its move yesterday as it raised interest rates by 75 basis points, the largest increase since 1994.

The hike is meant to combat Friday's 41-year high inflation reading, though Fed Chair Jerome Powell did say that a 75 basis-point hike won't be a common occurrence.

"The Committee decided to raise the target range for the federal funds rate to 1.5% to 1.75% percent and anticipates that ongoing increases in the target range will be appropriate," the Fed said in a statement.

US stocks — and also bitcoin — turned higher as Powell's presser got underway. Each of the major indexes gained after the announcement, with the Dow rallying as much as 500 points, or 1.4%, before Wednesday's closing bell. However, the latest market moves suggest these rallies were short-lived.

The decision by the central bank is set to make mortgages, car loans, credit-card debt, and other kinds of borrowing more expensive, part of the Fed's attempt to take some of the money contributing to uncomfortably high inflation out of the economy.

"The more aggressive stance can still be consistent with a softish landing for the economy, but the path is getting narrower," wrote Barry Gilbert, a strategist for LPL Financial.

You can listen to me talk about the Fed rate hike on today's episode of The Refresh from Insider.

In other news:

2. US stock futures fell early Thursday, as investors digest the Federal Reserve's latest monetary policy decision. Bitcoin had a slight rebound after almost falling below $20,000 Wednesday, but is now trading around the $21,000 level. Here's the latest.

3. On the docket: Beyond Air, Adobe, and Kroger Co, all reporting. Plus, look out for the unemployment insurance weekly claims report expected at 7:30 am ET.

4. Crypto is in a tailspin — but learning about the landscape and becoming a smarter investor can help. Fifteen leading experts recommended these 27 books to anyone who wants to better understand digital currencies.

5. Oil markets are pricing in long-term supply deficits, according to the IEA. The Paris-based agency issued several warnings about what 2023 fuel supplies could look like, including a forecast that OPEC+ will face historic lows in spare capacity.

6. The European Central Bank said it's preparing a new anti-crisis tool as a surge in bond yields brings back memories of the eurozone meltdown. The ECB is pivoting back into crisis-fighting mode ahead of potential interest rate hikes. Here's what you want to know.

7. Wells Fargo says the US will tip into a recession in 2023. After the Federal Reserve hiked interest rates, views have shifted on Wall Street, with analysts saying the risks of a recession are rising. Wells Fargo is not alone in becoming more pessimistic about the US economy.

8. Two real estate investing veterans explained why they're sitting on over $1 million in cash and poised to buy property despite rising interest rates. "Effectively, rates for me have gone up 50%," one of them explained. "But for any sound investor, it's not what something costs — it's what value is there."

9. This investor lost his life savings in Terra USD after putting $20,000 in it. Now he lives paycheck to paycheck and is wary to invest until there's more crypto regulation. Read how the stablecoin collapse impacted his investing journey.

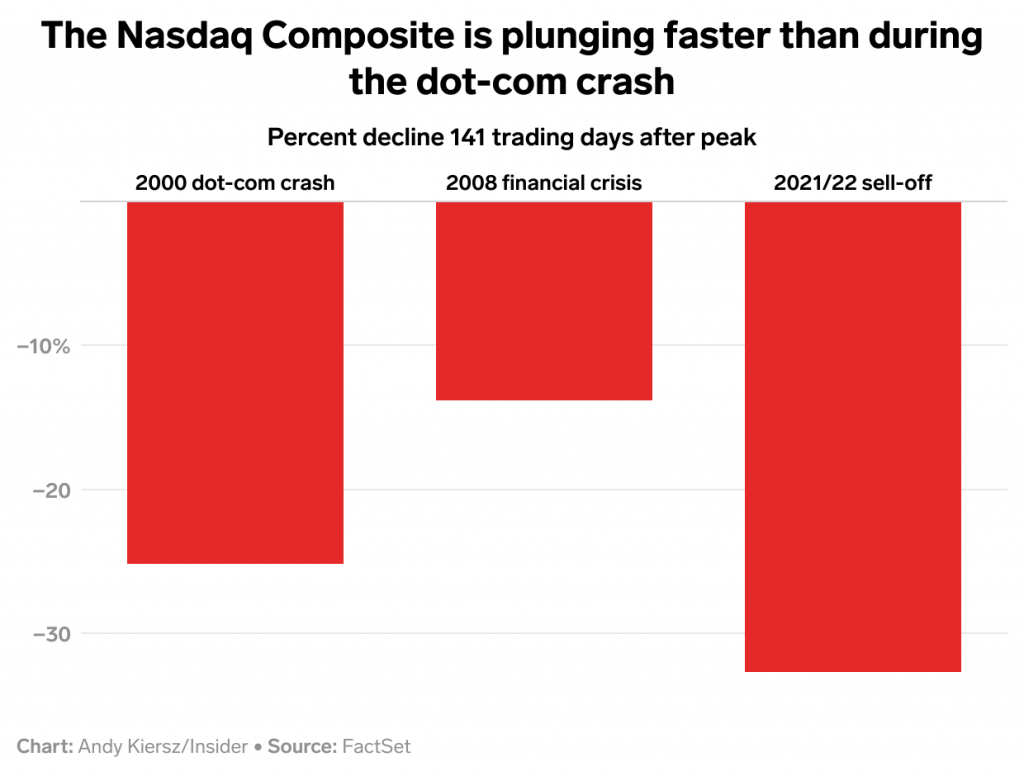

10. The crash in the Nasdaq is looking a lot like the bursting of the 2000 dot-com bubble. But the scary thing? In 2000 it fell for two more years and didn't fully recover until 2015.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn.) Edited by Max Adams in New York and Hallam Bullock (tweet @hallam_bullock) in London.